“We are proud to be the first financial institution in Luxembourg to migrate its entire financial core system to the cloud.”

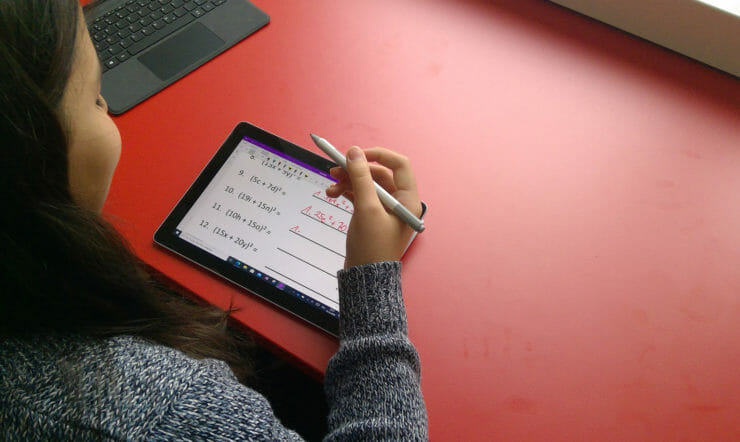

Laurent Pulinckx, CIO at Luxembourg Stock Exchange and his team have helped their company reach a significant milestone this year. By becoming the first financial institution in Luxembourg to be approved by the regulator Commission de Surveillance du Secteur Financier (CSSF) to move their IT infrastructure to the cloud, Luxembourg Stock Exchange is pioneering new ground amongst its peers.

“All financial institutions in Luxembourg are regulated by the CSSF,” explains Pulinckx. “And one part of those regulations are linked to the IT environment, because there is no finance without IT.

“The CSSF used to require all financial data to be stored within the territory of Luxembourg itself,” he continues. “But when the CSSF was working on a circular to give guidelines to allow financial institutions to move their systems to the cloud, we had already been defining the move in anticipation for a while.”

It was a long process to provide the CSSF with all the necessary security and operational assurances needed to gain approval, but with the help of Microsoft, the team at Luxembourg Stock Exchange have now successfully embarked on a future that will benefit from cloud-based data insights, agility and innovation.

“There were several options for us to choose from, but Microsoft was by far the most transparent in the way they managed security and incidents, which was a key factor for us when considering how to meet the CSSF framework requirements.”

A unique, sustainability-minded exchange

Founded in 1928, Luxembourg Stock Exchange is not a new institution, despite remaining relatively small in size. “We are about 130 employees and 30 external consultants in total,” says Julie Vichi, Communications Manager at Luxembourg Stock Exchange.

“And we are not a typical exchange,” she adds. “Our core business is the listing of financial securities, which are admitted to trading on the two markets operated by the exchange. The Luxembourg Stock Exchange currently counts more than 37,000 securities issued by around 2,000 companies, institutions and sovereign issuers in over 100 countries. The exchange has a truly global footprint and we provide issuers with access to international investors.”

In 2016, the company further differentiated itself from the competition when it launched the Luxembourg Green Exchange (LGX) – the world’s first and leading platform for sustainable securities. “It’s a platform for green, social and sustainability bonds as well as socially responsible funds, for investors who want to invest in projects that contribute to positive environmental outcomes, sustainable development, or social causes like education or fighting unemployment,” explains Vichi.

“So these are really financial securities that have a double role: they give you a financial return, but they also contribute to positive change.”

LGX has been “a true success story” that has led to Luxembourg Stock Exchange being awarded a UN Global Climate Action Award in the category of Financing for Climate-Friendly Investment.

“Sustainability is perhaps the most defining characteristic of Luxembourg Stock Exchange and we are following closely the efforts that Microsoft is making to decrease businesses’ impact on the environment,” says Pulinckx. “But there are two other words that define us too. Firstly, innovation. We want to be able to bring solutions to the market faster than anyone else. And secondly, we want to be agile. Because when you’re small like we are, agility is key.”

And it was this search – for greater agility and innovation – that ultimately led Luxembourg Stock Exchange to the Azure cloud.

Thinking outside of the box with cloud technology

“Before we decided to move to the cloud, we had what I would call a very traditional configuration,” says Kevin Lloyd, CTO at Luxembourg Stock Exchange. “It was a local data centre, offsite, nothing fancy, nothing glorious.”

“It was fine for a time,” he adds. “But when we looked at how Luxembourg Stock Exchange was evolving, that was really what pushed us to find a solution that would help us address the future needs of the business.”

“That’s right,” says Pulinckx. “You must remember that we operate on the listing market, which is highly competitive. To differentiate ourselves on that market, we need to think out of the box, to invent new products and find new ways of delivering services to our customers.

“So the question is: how can we be innovative?” continues Pulinckx. “And for me the answer is that we have to be able to be flexible, to try new things, which is not really possible with the old-fashioned, traditional infrastructure we had. That flexibility allows us to cope with the evolution of the market and to be able to propose new ideas fast, to be fast in the market.

“That is why we decided to consider moving to the Azure cloud in 2018,” he adds.

“Our goal is to be able to be much more agile in the way that we deliver new services to customers, but also to be able to link much faster with all the new FinTech start-ups that offer really good ideas and good value, so long as we can integrate them really fast. Azure allows us to do that.”

An integrated and transparent cloud solution

“As a corporate enterprise business, Azure is the smart choice,” says Lloyd. “Especially as we’re already using a number of different Microsoft technologies like Azure Active Directory and the Microsoft 365 stack. It’s the logical and consistent move, especially if you want to move your on-premise infrastructure to the cloud.

“It’s very much a one-stop shop,” he adds. “Tools like the Office suite and Microsoft 365 obviously integrate well with Azure, especially when you start looking at things like security and compliance and overall data protection scenarios as well.”

But the choice of Azure over the competition went beyond merely its compatibility with Luxembourg Stock Exchange’s existing infrastructure. It was also about the transparency, security and privacy that the Microsoft cloud could provide that others couldn’t.

“We looked at several options,” recalls Pulinckx. “But the analysis was that Microsoft was really transparent from a security perspective and in the way they could report an incident. That was a key factor for trust, needed also in the CSSF framework.

“Additionally, one of the rules that the CSSF has in place is the right to audit. It means that the CSSF must be able to audit the whole of the provider of the infrastructure for financial services, even if they are not physically based in the territory of Luxembourg. That was a criteria that we could also meet with Microsoft.”

An amazing team building a solution for the future

It is clear from talking to the team at Luxembourg Stock Exchange that making the move to the cloud has been a seismic transformation. “I think the dossier we submitted to the CSSF was around 400 pages,” says Lloyd.

The process has been made possible by the team the Luxembourg Stock Exchange has worked with from Microsoft. “The Microsoft team in Luxembourg are doing an incredible job to help us find our way,” says Pulinckx. “We have weekly meetings with them to support us. And we have also been getting support with specific bits of technology from the Microsoft Fast Track Team.”

“Yes, the Fast Track Team have been helping us with the migration to Microsoft 365 recently,” says Lloyd. “ And we’ve also had assistance with HDInsight, AKS, the data stack and using Power BI with our data factory, as well as strategic help on funding for certain initiatives that we have with Windows Virtual Desktop.”

With the focus so far having been on getting the architecture in place, Luxembourg Stock Exchange will now focus on moving more and more workloads across to the cloud.

“The objective for next year is to migrate all users to the new solution,” says Pulinckx. “But the real success will be when I see that this new infrastructure can help us deliver in a much more efficient way with time to market and to have much more contact with our customers in the really early stages of engagement.

“This move will give us that edge and allow us to continue to be innovative and agile.

“That is the ultimate goal,” he adds. “To allow Luxembourg Stock Exchange to develop solutions that bring real value for our customers, which at the end brings value for the whole financial ecosystem.”