In an era where financial crimes are rampant and vigilance is critical, innovative fintech company Lucinity has harnessed the power of Microsoft Azure OpenAI to reinvent its approach to financial crime prevention

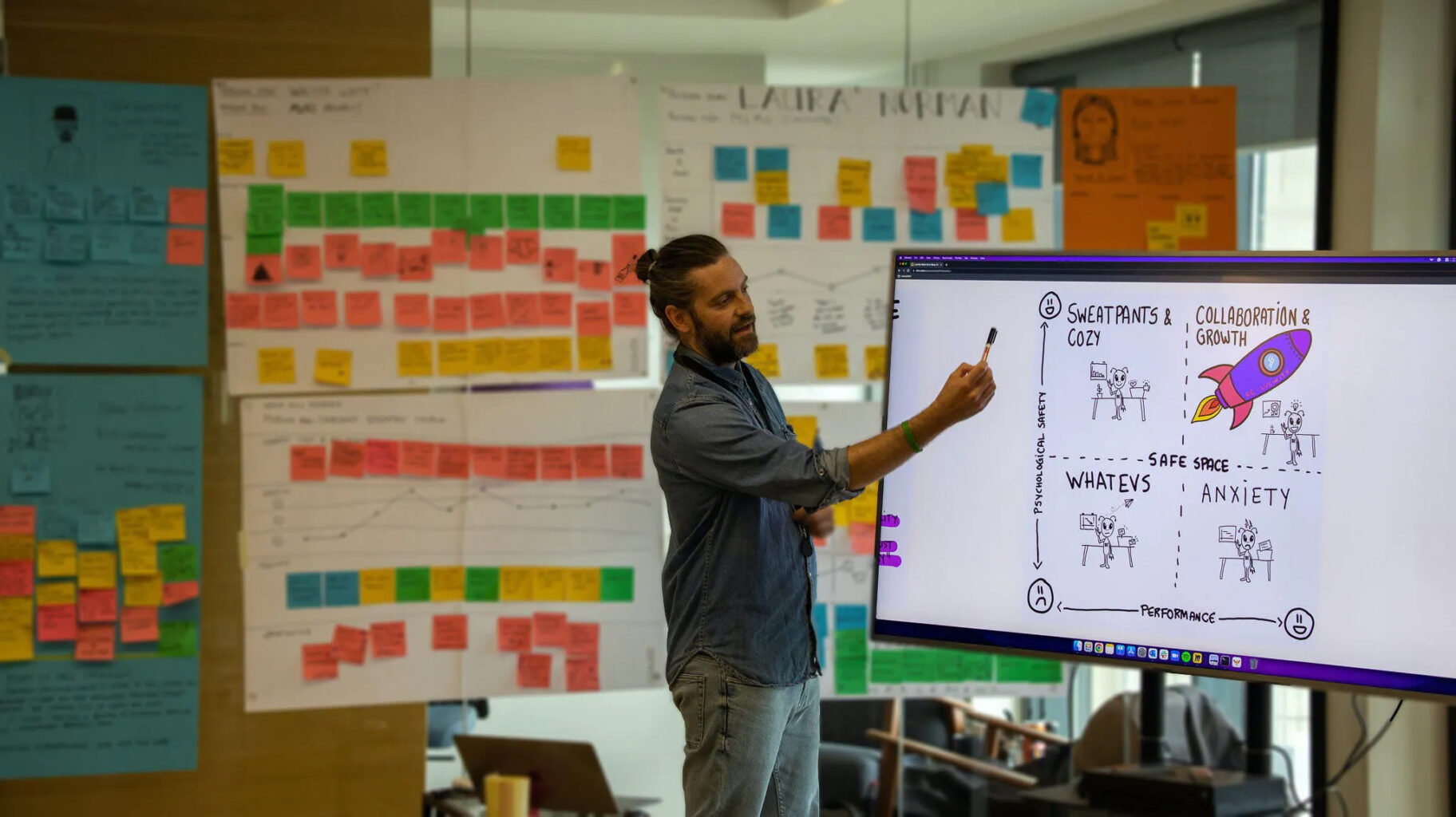

For many banks and fintech businesses, it is common to find frontline analysts and financial crime investigators spending several hours analyzing data, sometimes up to six hours of an eight-hour workday. Surprisingly, they are left with a mere two hours to make crucial decisions based on the very data they’ve been poring over. This is due to both the overwhelming amount of data to comprehend and the multitude of cases that demand their attention. Icelandic start-up and Microsoft ISV partner, Lucinity, was created to address this problem. Under the tagline “Make Money Good” Lucinity uses and combines cutting-edge technologies such as OpenAI and Azure to deliver faster and smarter financial crime prevention that can yield 60-80% process improvement.

Lucinity’s primary focus lies in offering a customer-centric solution for financial crime review. They achieve this by seamlessly combining customer transaction data, CRM data, and alerts from various systems. Through the careful aggregation of this wealth of information, Lucinity generates comprehensive behavior profiles for each individual customer, enhancing customer intelligence. These profiles are then utilized in a risk-compliant manner to promptly identify and notify any instances of suspicious behavior.

Technology that allows focus on core business

“Imagine that you are a bank, and you have a compliance team of say, 1000 people. Our technology means you could potentially scale the team down to a couple of hundred people and redeploy resources to the revenue side of the business while still maintaining the same level of effectiveness in terms of analysis and decision-making. This is not only a huge cost saving but also allows the bank to focus more on their core business, which is lending money and managing investments, not on compliance,” says Guðmundur Kristjánsson, the CEO of Lucinity.

What is truly innovative about Lucinity is the development of their AI-powered copilot, named “Luci.” Luci takes center stage in Lucinity’s platform, providing an intuitive conversational interface and leveraging diverse data sources for comprehensive background checks and extensive searches. The introduction of Luci proves instrumental in transforming productivity levels at Lucinity. Previously estimated to range between 30-50%, productivity experiences an astonishing leap with Luci, skyrocketing to an impressive 60-80%. This substantial boost amplifies the effectiveness and efficiency gains for financial crime investigation teams, transforming the way they operate.

The second part of Lucinity’s solution is a workflow solution that initiates when any signal of potential financial crime is detected. “The real magic here is the use of augmented intelligence to turn that signal into an easy-to-review narrative, enabling quick, informed decisions by human operators”, Guðmundur Kristjánsson says and continues: “A key point is that our solution goes beyond just transactional monitoring. The real value lies in slashing the review process from hours to minutes. Our use of behavioral analytics also makes the system far more individual-focused than most current, rule-based systems, increasing the effectiveness and efficiency of transaction monitoring. Guðmundur Kristjánsson himself has a background in behavioral analytics and natural language understanding and has been working within this field for the past 15-20 years.

“We found out that OpenAI on Azure was wonderful for several reasons. Firstly, it fits so well with our platform that we had been developing for four years. Secondly, the combined data security of OpenAI and Microsoft Azure really excited me. When I saw it, I knew that we had something valuable to offer to our clients,” says Guðmundur Kristjánsson.

We are extremely good at looking into financial crimes processes and streamlining them using Microsoft Azure.

– Guðmundur Kristjánsson, CEO of Lucinity.

He emphasizes that while the cost might not necessarily decrease with this system, it does not increase either. The reason for this is the focus on not just generating results, but on explaining them as well. This approach sets Lucinity apart, making their solution not just a monitoring tool but also a tool for understanding and explaining financial transactions.

Banks spend more than 230 billion – and actually, I think this year it will rise to 250 billion – on financial crime prevention. So, there is a massive need to improve.

– Guðmundur Kristjánsson, CEO of Lucinity.

The huge potential across sectors

The problem, according to Guðmundur Kristjánsson, isn’t the willingness of the banks to improve but the complexity involved in detecting genuine issues. His team’s innovative solution targets this very complexity. The AI system not only aims to save the banks money but aspires to report real signals to the regulators, which currently proves to be a significant challenge.

As part of Lucinity’s initiative to reinvent the way that anti-money laundering is detected, Guðmundur Kristjánsson’s team announced Project Aurora, a collaboration with the Bank of International Settlements and the Nordic Innovation Center. This project has been working on collecting and sharing signals across ecosystems, banks, and potentially across Europe without compromising privacy.

When asked if the service could be applied to other marketplaces, Guðmundur Kristjánssons revealed the wide applicability of the solution. The team initially decided to start with the FSI sector with plans to expand later. “Any organization that needs to monitor large volumes of transactions, like insurance companies or government agencies, could benefit from this technology. It’s a game changer for anyone in the field of financial crime detection and prevention”, Guðmundur Kristjánsson says.

“We are still learning how to leverage the benefits that Microsoft has to offer. Though this learning curve has been steep, I am very grateful for the support and value provided by Microsoft through technical review, account review, and help in understanding opportunities and how to approach them.

Despite the technological leaps they’ve made, the Lucinity team remains committed to their central ethos, “Make Money Good,” hinting at their dedication to transform not just how banking compliance is done, but the very ethics of financial transactions.