“Our story is a story about transformation. From traditional architecture and technology towards flexible and state of the art services to our clients and partners, based on cloud solutions”

–Johann Blais, Head of Architecture and Technology, Advanzia Bank

Johann Blais is Head of Architecture and Technology at Advanzia Bank. Over the last years, he headed the team that radically changed its approach to infrastructure and architecture to meet the growing need for flexibility that modern banking institutions require. All this is to remain competitive internationally and form the basis for future growth.

“Our transformation process is characterized by speed and efficiency. In doing so, we are the first digital bank in Luxembourg to move our infrastructure towards the cloud. The whole process was met with the approval of Luxembourg’s financial sector regulator Commission de Surveillance du Secteur Financier (CSSF).”

The need for change and speed

Johann explains the situation of the bank and their need for transformation and support.

“Advanzia is an important credit card issuer in Europe. We operate exclusively online and are not present in the current account business or the so-called “traditional” banking sector. We issue credit cards to consumers through our online platforms and through co-brand partnerships, and work with partner banks with whom we offer complete credit card solutions and end-to-end services, and we are growing steadily across all our business lines.

We have made significant investments towards digitizing the platforms on which we interact with our cardholders. But a great front-end alone is not enough; we needed our back-end systems to follow, to deliver a better user experience.

Our traditional server infrastructure and architecture did not always guarantee flexibility, or it took much too long to get changes operational.

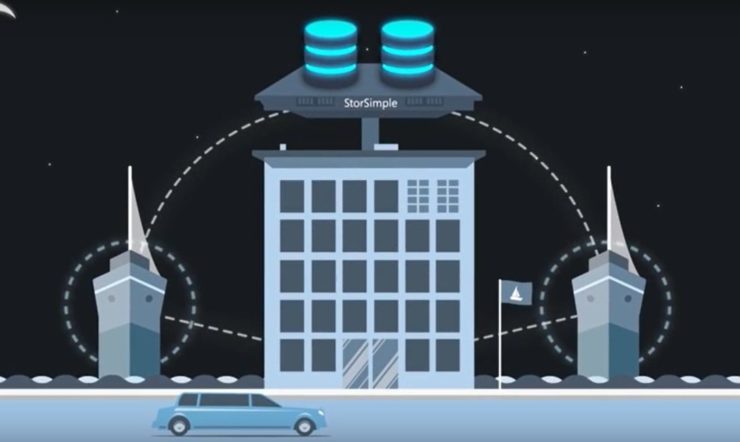

That was the main reason we built the new infrastructure in the cloud using native cloud technologies and adapted our systems towards Microsoft’s Azure Cloud. On the front-end of our system, our partners can implement changes on a weekly basis. Our traditional architecture was not capable of following the rhythm. You have to be aware of the enormous challenge those changes pose in terms of systems, testing and implementing the changes.

We want to evolve towards a very lean and agile structure as an organization. So, we had to rethink our processes fundamentally rather than look for short-term answers.’ Johann explains, emphasizing that the whole organization is involved in the transformation process.”

Preparation, openness and interaction

Johann Blais explains: “We did everything possible to inform and keep everyone involved and up to date. Security is very high on our priority list. So, we almost continuously talked to our internal stakeholders to convince them of the need to change and how we wanted to tackle cloud security. We documented how we would manage trust, reliability, confidentiality, and privacy in the new infrastructure, ensuring compliance with the CSSF’s requirements.

Advanzia stresses the importance of partnerships and openness in the process. “Some stakeholders were surprised that the regulator agreed with our proposed transformation. I am convinced that this is the result of three factors. We were well prepared when we presented the project, we were open about our needs and the consequences for the operational part of the bank, and we showed how we have been working with trusted partners over the years. All these elements played in our favour.”

“Introducing new technology to traditional infrastructure can take anything between 9 and 12 months. Now we implement in less than two months.”

-Johann Blais, Head of Architecture and Technology, Advanzia Bank

Tangible changes and advantages

“The most significant advantage is the reassurance that the platform can handle our growth. The second major benefit is that our people now work differently and smarter. Right now, in our operations, whenever there is a manual intervention, we start questioning the necessity of that intervention and see it as a possibility to automate even more. It’s an entirely different mindset, supported by infrastructure as a code.

This way of working has also changed our cost structure, allowing us to decide more fluently and proactively. Testing and changing is no longer a tedious and risky process. It goes very fast and allows us to experiment, improve, and try new technologies without significant new investments. Introducing new technology to traditional infrastructure can take anything between 9 and 12 months. Now we implement in less than two months. And the same goes for small scale experiments.

Setting up a new application environment typically took three weeks with three people; our advanced automation now takes care of that in a couple of hours, supervised by one person. It increases flexibility, creativity, and agility.

We shifted from investments to operational costs, but this is also in line with the bank’s operating model. We don’t want to increase capital expenses. Having the cloud as an operational expense gives us more flexibility and scalability, as we pay for what we need when we need it.”

Valuing your team, your people

“At Advanzia we work with very skilled and capable system engineers. Our people were spending a disproportional part of their time on operational tasks whenever we needed to implement a change. Now they are entirely focused on the implementation of changes within the system. It’s a much more rewarding situation that allows our people to grow and develop our omnichannel approach to the market.

Even though Advanzia exists in a purely digital capacity, there is a multitude of touchpoints with our cardholders (app, customer portal, website, etc.). We wanted both the customer journey and the customer experience to be consistent, fast, secure and user-centric.

It’s about putting the customers back in the centre of our processes and activities.”

Trusted partnerships

“Our collaboration with Microsoft has been exemplary. Not only in terms of reaching an agreement over specs and functionalities but also in terms of rollout and getting our new architecture up and running. I am a firm believer in long-term and stable partnerships.

Microsoft has been a long-term partner for Advanzia Bank, here on the technology side, even considering data centre infrastructure. We have been using Microsoft technology for a long time, and we’ve always had a good working relationship. That is why we could perform this transformation so fast and without major hiccups. The consultants, the engineers, our people, we were all on the same page.

Microsoft advised us to evolve towards a serverless infrastructure. This implies that you get rid of a lot of your traditional server infrastructure. You just focus on the very thin layer where you put your actual intellectual property and concentrate on what you want to implement and change.

The whole transition process, the collaboration with both external and internal experts, once again demonstrated the need for extreme flexibility in today’s marketplace.

We are not just talking about the speed of execution, but mainly about a profound rethinking and redesigning of business processes and the accompanying IT infrastructure to allow for agility and security. Modern banking is evolving at an ever-increasing pace, representing huge challenges.”